Originally published at: 5 Points On How Crypto—And Trump Crypto Corruption—Are Causing Drama In The Senate - TPM – Talking Points Memo

A $2 billion Trump-branded crypto deal. Access to the President auctioned off to top holders of $TRUMP coin. Businesses bragging about spending $20 million on the President’s branded crypto coin in a bid to gain influence. President Trump’s crypto ventures are, on their face, a mess of corruption that looms over 2025’s politics. In its…

Make it all illegal within the US unless it’s regulated by the SEC and follows the same rules all other banking does. It’s primarily used for speculation, tax evasion, and crime. Proper regulation would be a death knell. Good riddance.

I think we’re past the point of legislation meaning or enforcing anything, unless it’s against a Democrat. We’re in a half lawless nation. Passing a bill is, I suppose, a great thing to point to, and to try to get a judge to look at after 30 months of litigation stalls.

The key to putting the brakes on the current grift free-for-all is getting GOP senators to understand that they’re marks too, and that all the wealth is flowing to and between the diaperload and his billionaire pals and bazzillionaire sheiks. Maybe if they get irritated enough they’ll attempt to retrieve their balls from whatever shelf he has them on. Otherwise legislation is in the same pile of discarded docs as the Constitution.

Russian Intelligence’s spectacular decade goes on. Feed our own lies to us, and let the greedy rich rob the store.

Posting for the bazillionth time, because it is appropriate for the bazillionth time.

Dismantling one agency after another purportedly to control waste and corruption. They are replacing them with a level of corruption unseen since maybe the Harding admin or in some banana republic.

My question when discussing Crypto is: What the hell good is it? What does it do that is not already being done?

With the above in mind, in December in the wake of Trump’s election Paul Krugman had this to say about Crypto.

Crypto is for Criming

It’s not digital gold — it’s digital Benjamins

Dec 16, 2024

1,699

313

[

Share

](javascript:void(0))

The tech bros who helped put Trump back in power expect many favors in return; one of the more interesting is their demand that the government intervene to guarantee crypto players the right to a checking account, stopping the “debanking” they claim has hit many of their friends.

The hypocrisy here is thick enough to cut with a knife. If you go back to the 2008 white paper by the pseudonymous Satoshi Nakamoto that gave rise to Bitcoin, its main argument was that we needed to replace checking accounts with blockchain-based payments because you can’t trust banks; crypto promoters also tend to preach libertarianism, touting crypto as a way to escape government tyranny. Now we have crypto boosters demanding that the evil government force the evil banks to let them have conventional checking accounts.

What’s going on here? Elon Musk, Marc Andreesen and others claim that there’s a deep state conspiracy to undermine crypto, because of course they do. But the real reason banks don’t want to be financially connected to crypto is that they believe, with good reason, that to the extent that cryptocurrencies are used for anything besides speculation, much of that activity is criminal — and they don’t want to be accused of acting as accessories.

But let’s back up a bit and talk about fundamentals.

One of the (many) odd things about cryptocurrency is that it has somehow managed to maintain an image as something futuristic when it’s actually ancient in tech years: Bitcoin, the original cryptocurrency, which still accounts for more than half of the total crypto market cap, is 15 years old. Over this entire period, monetary economists and banking veterans have asked, what’s this for? What legitimate use cases are there for cryptocurrency that can’t be served more easily without the blockchain rigamarole?

I’ve been in many meetings where this question has been raised, and have never heard a coherent answer. In fact, crypto has made essentially no inroads on conventional money’s role as a means of payment — which is why crypto guys are so angry about being debanked: you can’t do business without an account at one of those banks Bitcoin was supposed to replace. Even the crypto industry’s own employees won’t accept payment in crypto, which is why the failure of Silicon Valley Bank, where they deposited funds for payroll, was an existential crisis demanding, yes, a government bailout.

Yet Bitcoin has hit $100,000 and cryptocurrency assets have a combined value of $4 trillion. What’s going on?

One answer you sometimes hear, especially from financial executives who want to say something positive about crypto, is that Bitcoin in particular may be turning into the digital equivalent of gold. After all, gold doesn’t really function as money — try buying a car with gold bars — and its industrial and dental uses, while real, don’t remotely justify its value. It’s just an asset that people consider valuable because others consider it valuable, and it has maintained that status even though gold coins went out of use as a means of payment generations ago.

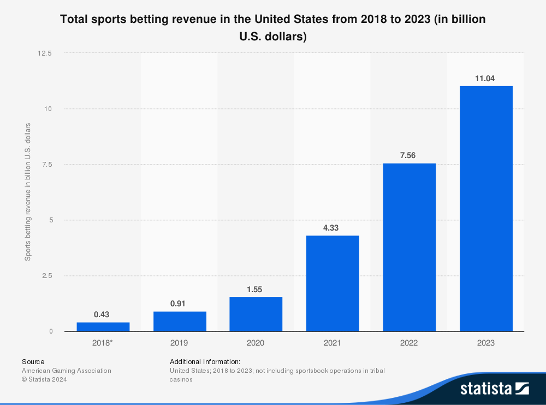

Another answer is that it’s all speculation or gambling (sometimes it’s hard to tell the difference), largely driven by testosterone. A Pew survey found that 42 percent of men 18-29 (versus 17 percent of women) have invested in, traded or used cryptocurrency, even though it’s extremely hard to use in ordinary life — the car dealer who won’t accept gold bars probably won’t accept Bitcoin either. The surge in crypto has gone hand in hand with a surge in meme stocks like GameStop and political bets, not to mention an enormous and worrying surge in sports betting:

But there’s a third possible explanation of crypto’s rise. Maybe asking “what are the legitimate use cases for this stuff” is the wrong question. What about the illegitimate uses, ranging from tax evasion to blackmail to money laundering? Maybe crypto isn’t digital gold, but digital Benjamins — the $100 bills that play a huge role in illegal activity around the world.

The old adage says that crime doesn’t pay, but of course it does in many cases. And it needs a means of payment, preferably one that isn’t too easily tracked by law enforcement. Traditionally, and to a large extent even today, that has mostly meant large-denomination banknotes.

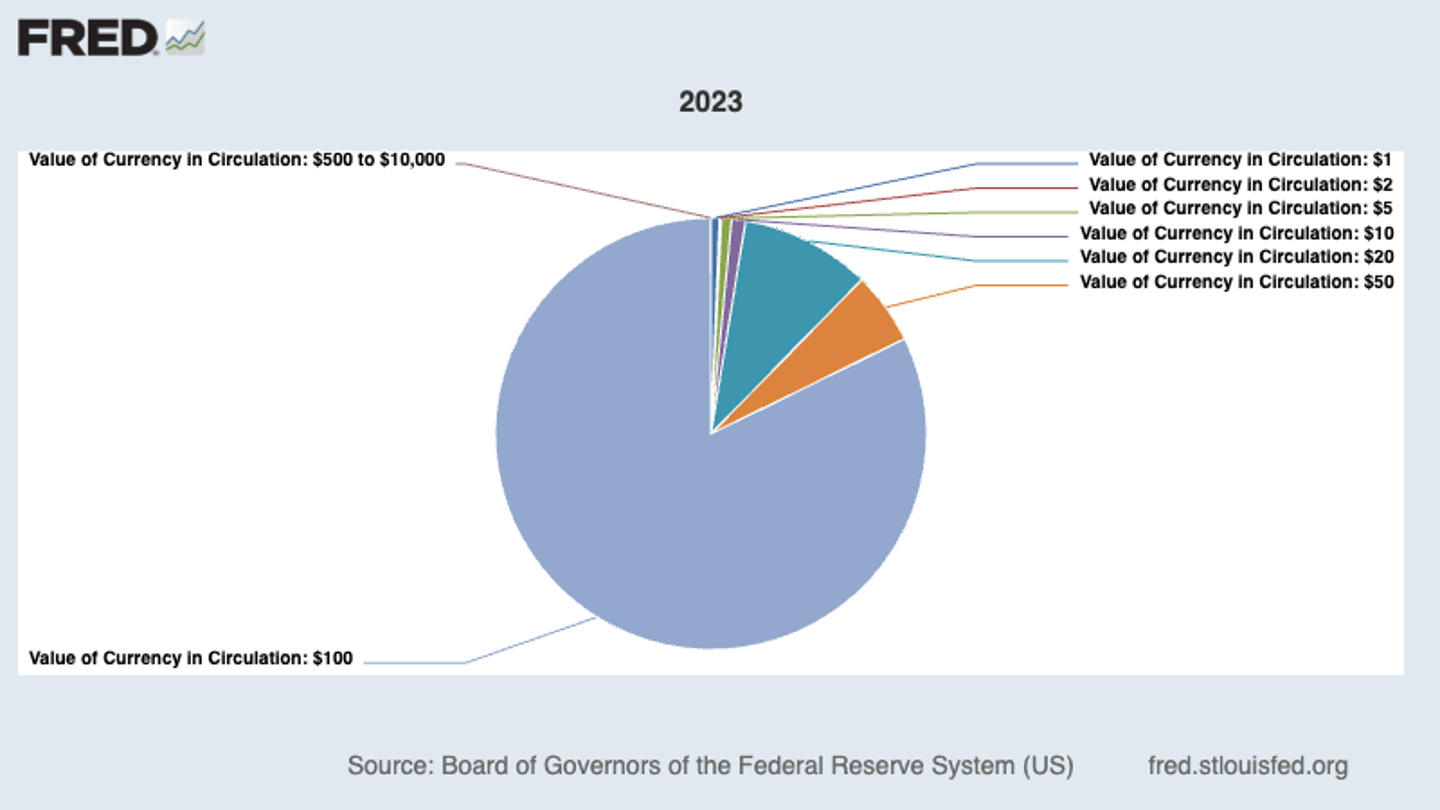

I don’t know how many people know this, but the great bulk of U.S. currency in circulation, at least in terms of value, consists of $100 bills:

Most people can go a whole year without ever seeing a $100 bill — yet there are roughly 60 such bills in circulation for every man, woman and child in America. Who’s holding them? Well, indirect evidence suggests that they’re mostly being held outside the country. And while getting a precise number is almost by definition impossible, there’s no real doubt that many and probably most of the Benjamins out there are being held for illicit purposes. That’s why some prominent economists, notably Ken Rogoff, have called for completely phasing out large-denomination notes.

But while the sheer value of $100 bills in circulation suggests that there are still plenty of tax evaders and drug dealers with safes full of cash, banknotes are an awkward medium for really large-scale criminal activity. True, $1 million in $100 bills only weighs 22 pounds; but a million isn’t that much money nowadays. When Bashar al-Assad sent $250 million to Moscow in the form of $100 and 500-euro notes, the cargo weighed two tons.

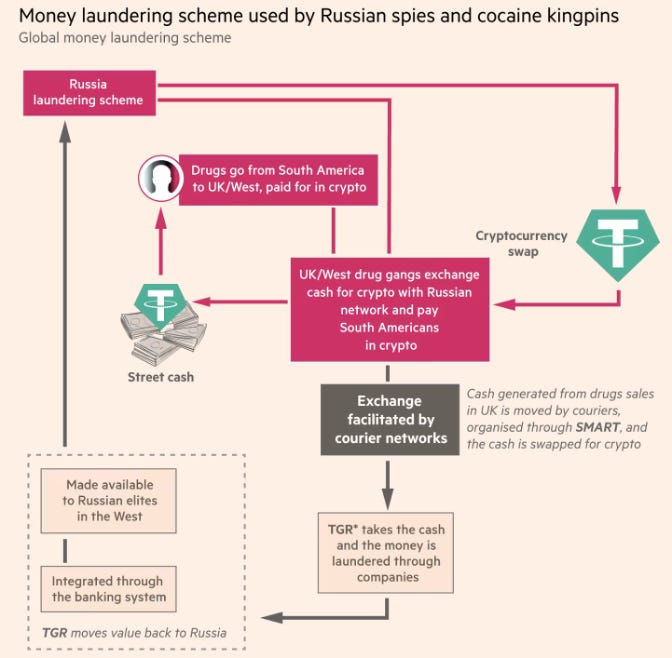

Enter crypto. British authorities recently broke up a big money-laundering scheme involving exactly the villains you’d expect:

Presumably not everyone in crypto is participating, even unknowingly, in criminal activity. But the use of crypto for money laundering appears to be rising rapidly. And if I were running a bank, I’d be reluctant to host a bank account belonging to someone who might be involved in unsavory activities.

You might think that this was my right. Aren’t banks private companies, who can choose which customers they want to serve? OK, we have laws against discrimination based on race or gender, but civil rights for crypto bros sounds like a stretch.

Or maybe not. Howard Lutnick, Trump’s choice for Commerce secretary, has close ties to Tether, the company that is at the heart of the scheme the UK just uncovered and is rumored to play a large role in money laundering in general.

We’ll see what happens. But what Musk and Andreesen are demanding could be seen as a call for the U.S. government to intervene to make life easier for criminals. And if you think such a thing would be inconceivable under the second Trump administration, you haven’t been paying attention.

I originally read, “stablecoin showdown,” as, “stablecoin shakedown.” I wonder why?

The fact that the entire government is just sitting back and letting Trump get away with this is mind boggling. I get that the Democrats have no power, but they should be out there on every news program talking about Trumps grifting… The CRYPTO and the Plane. I would not hold my breath waiting for John Roberts and his Republican toadies to do anything.

Thomas got his free bus and a house for his mom. He’s not going to see a conflict. Alito is just nuts and a firm believer in IOKIYAR. It really comes down to Roberts and Boofnuts. What a world we live in.

They might want to be talking about Pelosi’s grifting as well. Nancy and hubby been at it for decades.

The South Sea bubble, tulip mania, mortgage-backed securities, crypto…

That’s part of why they like the GENIUS Act: if it became law, it would set standards

Once upon a time, my hometown had no payday lenders. One day, a 7-11 disappeared and a payday lender took its place. Soon another. Others popped up like mushrooms after a rain.

The young man was curious, and asked a financial expert how come there were so many payday lending places opening?

The wise old man replied that the state had just passed some legislation, defining the practice and regulating it. “Without that legislation,” he added, “Too much risk.”

Unfortunately, they have to be invited.

Trump is involved in crypto. That should signal to everyone just how corrupt crypto is.

There is absolutely nothing, and I mean literally nothing that anything related to crypto currencies, has of any tangible productive economic value.

I’m entirely pissed that there are any Democrats giving any validity to the entire space. The more enmeshed this entire vaporwealth is allowed into our legitimate financial system, the much greater the financial crash will be.

It’s fucking an absolute insanity.

In light of everything else that is happening, there is this, Trump is breaking all the rules in regard to refugee status so as to give White South Africans immediate access to the USA at taxpayer expense. My only comment is if I were a terrorist who wanted to get into America, under Trump all you have to be is White.

My association for “stable coin:” mortgage backed securities.

The 2008 financial crisis was primarily due to derivatives on derivatives. Puts and Calls on Futures contracts and Indexes.

Now we about to layer all of that nonsense on top of Crypto Futures Indexes.

Betting on Wishful Thinking.

What could possibly go wrong?

Part of the problem is the Dem support for crypto. I’m now kinda embarrassed that I wrote postcards for Gallego, though it was good that he beat Kari Lake.