Tesla CEO Elon Musk, who recently bought a 9.2 percent stake in Twitter and thus became its biggest shareholder, has upped the ante in his bid for control over the social media giant with a new offer: to buy the company for $54.20 a share, which amounts to about $43 billion.

This is a companion discussion topic for the original entry at https://talkingpointsmemo.com/?p=1413194

1 Like

Pump and dump. Typical Elon.

24 Likes

All the while the Super Troll is being sued for what looks like an underhanded purchasing of Twitter stock.

Excerpts:

The lawsuit argues that by filing his disclosure so late, Musk, the CEO of Tesla and Twitter’s top shareholder, violated a securities law requiring shareholders to alert the SEC within 10 days after they exceed a 5% ownership threshold in a company. Rasella’s suit alleges that Musk’s Twitter investment exceeded 5% by March 14, but he continued to buy up Twitter shares at about $39 per share and failed to disclose his stake until last Monday. At that point, it was revealed that he commanded a 9.2% stake—or 73.5 million shares—in the social media company. On the day Musk disclosed his Twitter stake, the company’s stock price surged by approximately 27%.

———————————————————

Numerous legal and securities experts seem to agree that the overdue filing potentially netted Musk an estimated $156 million, according to The Washington Post . Likewise, Alon Kapen, a corporate lawyer for law firm Farrell Fritz, said in a statement to CNBC that Musk gave himself an “extra 10 days in which to buy additional shares (he increased his ownership during that time by an extra 4.1%) before the per-share-price spike that occurred when he finally announced his holdings on April 4.”

22 Likes

Legitimate class action lawsuits are hard to find. That’s a good one.

26 Likes

Musk is an oligarchic ass. Done with Twitter if they accept his offer.

11 Likes

He’s a mentally unbalanced billionaire who fancies himself a superhero. That should be enough for Twitter to say ‘No deal’.

11 Likes

This SOB should be ineligible from buying Twitter or any other publicly traded company just because of his repeated violations of SEC rules.

17 Likes

Another reason to reject his offer: he clearly does not understand financial law.

8 Likes

It’s easier for Musk to threaten Twitter than actually do his job and criticize Governor Abbott.

25% of the parts used to manufacture Teslas are made in Mexico - and Abbott’s latest bit of political theater is seriously delaying cargos moving into Texas. Tesla’s “giga-factory” won’t be contributing much to Elon’s bottom line if they’re forced to shut down.

So what does Musk focus on? Bullying Twitter. (And probably hoping to manipulate the stock price)

But that’s much easier than admitting that moving Tesla from California to Texas - a “pro-business” state with a decrepit power grid and politicians that care more about staging political theater than good governance - was a big mistake.

16 Likes

We had a mentally unbalanced ‘billionaire’ bid to become POTUS. Sadly, enough morons said YES.

9 Likes

“They let you do it when you’re a star…”

6 Likes

Instead of “billionaire” I’d instead describe him as “heir to a fortune”. Otherwise - spot-on!

He is where he is today because of his inherited wealth coupled with pro-wealth policies in the US. Not because he’s actually any good at business.

8 Likes

If Elon Musk takes over Twitter, it will be a great opportunity for me to stop wasting my time on Twitter.

17 Likes

Now that MySpace is no longer owned by Rupert Murdoch - I wonder if the current owners are paying attention to Musk’s antics?

2 Likes

That’s unfair. I think it quite likely that Mr. Musk understands financial law as well as anyone… he just doesn’t want it to apply to him.

10 Likes

Thanks for the clarification.

1 Like

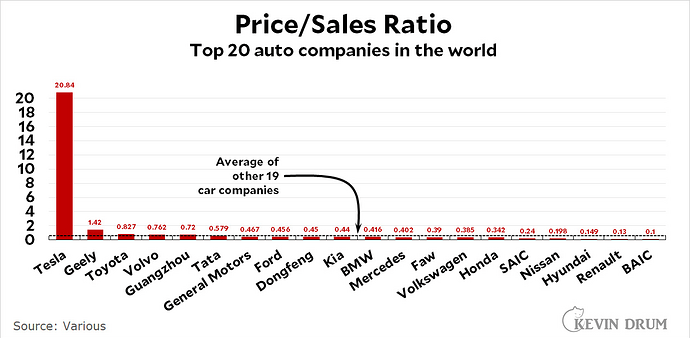

Tesla’s stock price is completely divorced from its actual business operations. It’s a bubble that will eventually burst, but that burst isn’t likely to come from anything like a temporary manufacturing slowdown.

From Kevin Drum the other day:

15 Likes