That can work. Raising the zero bracket also works.

“The GOP’s New Clothes”

[I’d post a photo, but the thought of looking at a bunch of naked pols right after breakfast…urp]

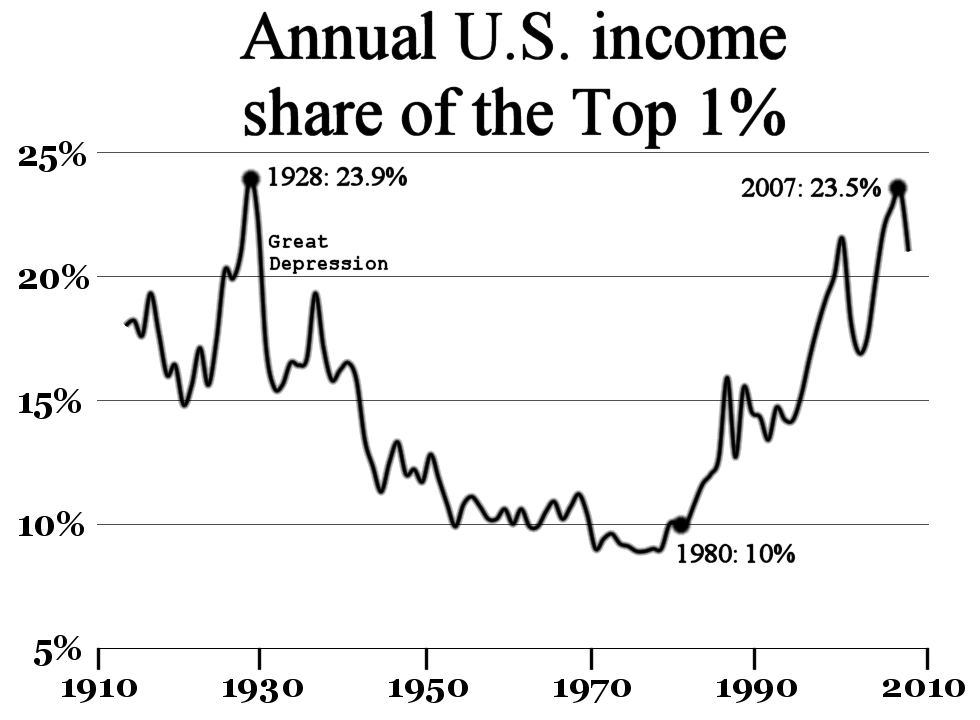

It’s a fairly simple fact of economics. Low taxes on the very wealthy leads to high wealth inequality because the very rich get to keep more of their money. High wealth inequality leads to negative economic growth because the very wealthy don’t put their additional money back into the economy; they ship it to the Cayman Islands or Switzerland and use it for keeping score. An expanding economy requires demand. Demand is created when people have money they want or need to spend. Making the rich richer does not grow the economy. This was proved in 1929 and again in 2008. Even the Pope has figured this out.

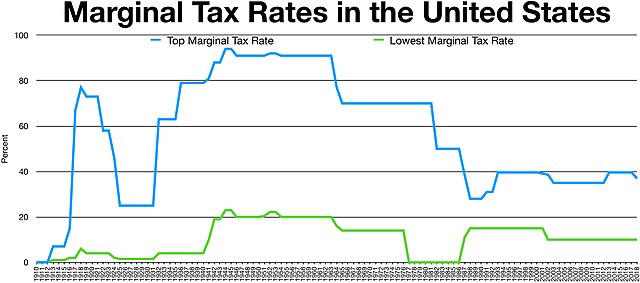

This can be seen from the following two charts which illustrate income inequality and top marginal tax rates in historical perspective.

While correlation does not prove causation, repetitive instances of the same correlation do tend to strengthen an argument.

I guess I could be okay in assuming that tax cuts could spur some modest growth, but the effect, as always is nowhere close to their estimates. On Marketplace two days ago, some House GOPer (can’t remember the name) cited some bull-shit right wing pro-tax “think tank” estimate that said the tax cut would generate a 9% growth rate. That is INSANE. It never got that high during the dot-com bubble. I don’t think the US has ever had a sustained growth rate that high–certainly not in recent times (meaning since 1950). It may have for a few quarters, but not much more than that. I wonder if that is the sort of crazy projection that is needed to make it ‘revenue neutral’

This idea sounds kind of logical. The trouble with it is- it doesn’t work. It has never worked. And it’s not going to work. Taxes on a national level are difficult. I’m sorry, but they are. I can see the desire to simplify, to make more fair. OK. But cutting taxes on Mega Giant Corp. and it’s wealthy owners will make them wealthier and leave the rest of us with the weeds. That’s reality.

They don’t. We’ve been fed the lie for years.

Here’s the thing: because of the way that economic stimulus depends on re-spending, tax cuts for the poor and the middle class will always generate more economic activity than tax cuts for the rich. Rich people get a tax cut, they sit on it (sometimes they invest it in derivatives). Poor people get a tax cut, they spend it at places that turn around and spend it again and so forth.

But it gets even worse than that. Tax cuts are supposed to be balanced by government spending cuts, and most government spending goes ultimately to people who are middle class or poor. Transfer payments, of course, but all those government employees and all the employees of government contractors. So when you give a tax cut to the rich, you get negligible economic stimulus from the added money in the hands of people who don’t spend it, and you get substantial anti-stimulus from the reduced money in the hands of people who do spend it. (Plus a lot of extra pain and suffering, which is usually a feature in the republican plans.)

You’d think, just once, that someone from the media would ask a Republican politician to provide an example of a previous tax cut that has paid for itself.

Just ask them for one example. Can’t be too hard, right?

Remember when America was “great”, as defined by those Rust Belters who handed Trump the White House? It was in the 50s and 60s. Civil rights and the Cold War aside, upward mobility was still a thing for the working class and a factory job got you into the middle class and home ownership. I wonder what taxation looked like back then? Oh, hey, look here! Top income rates were much higher and unions were strong!

Shit, if only there were a party that valued labor and sought increased taxation on wealthier earners… Oh well, I’ll just keep voting for Republicans because they like guns!

[/snark]

In all seriousness though, fuck Laffer and fuck anybody who ever bought into that shit. I hope Reagan is writhing in hell right about now.

Trickle down…my butt!

@machoneman Eeeeeeewww, I just finished breakfast.

Trump didn’t write it.

It was ghost-written for him, and the real author regrets having done it.

Trump couldn’t write a simple declarative sentence.

Things that make pass-through unworkable for corps trading publicly:

–lots of share trading

–institutional shareholders

–non-US shareholders

–shares held in tax-advantaged accounts

etc.

The factors above, and others, make it difficult to allocate the taxable profits, to determine the tax liability of shareholders, and to collect taxes for the US Treasury. There is the added problem of shareholders incurring tax liability, but not receiving cash to cover that liability.

Net losses would mean allocation of losses, too. That’s another mess.

Also, the allocation of taxable income to individuals would require many more people to file quarterly estimated taxes.

Pass-through is okay in theory, but a mess if implemented.

Nice graph. You can’t deny that the rate of GDP growth (slope of blue line) increased coincidental with lower income tax rate. Causation is implied, but not proven, as many other factors could be charted to show coincidence. For example, the emergence of information technology, perhaps shown as internet traffic counts. All such factors acting together might be causative, but to what degree? Impossible to prove. The temporary setback 2007-2009 can be pinned to specific causes that have little to do with taxation, for which the guilty escaped punishment.

Hate to say but how could anyone tell? I’m not trying to pick on LA but you guys are the “whole another country” that Texas stole from you guys.

Yeah, and the real author basically said the same thing: Drumpfie knows how to intimidate, not negotiate.

No surprise here. Everyone knew he was going to announce something that would be impossible to pass. He’s blowing hot air and is once again controlling the media hour by hour.

USA meet Kansas. Kansas meet USA. I have a feeling that you’re going to have a lot in common with one another.

No wall, no travel ban, no tax plan, no sanctuary city funding ban, no obamacare repeal, no Mike Flynn, chaos in the White House. The list of Trump’s accomplishments is stunning.

I hope everybody has their forms ready to become pass-through entities. Donnie & family are well ahead of the curve on that front.

@lizzymom He blusters and then he folds like the cheap suits he wears. It’s his cowardice that will inflict the most damage on the US, and I hope whoever runs in 2020 calls him out for the yellow-bellied squealer he is.