You mean like a Trump deal that went to the dogs?

And shockingly (not really), taxpayers who are represented only by Democrats. In the Senate, that is; there are House Republicans from NY, CA, etc., hence the difference between the two versions.

And to everyone here, there’s too little mention of the GOP budget that these efforts are based on, which plans for steep cuts in Medicare and Medicaid to pay for the tax cuts down the road. Time to start including that fact in every discussion of this “reform” effort.

Along with who is Senator or Representative so-and-so’s biggest local donor is.

A modest proposal in re The Estate Tax: repeal it, but only in combination with maintaining the original basis at which a capital asset was purchased. Heirs must pay taxes on the entire capital gain, not just the gain since the asset was transferred. One other provision, decrease or eliminate the lower tax rate for capital gains vis-a-vis salary/wage income.

I’m interested in reading an analysis on the impact of this idea, which I believe might remove the estate tax as a political cudgel.

Both houses claim to have cooked up a tasty meal for the middle class with years of patient labor in the kitchen. In fact, one house cooked up a hasty batch of white lightning cut with methanol and flavored by the tasty lead salts leached out of the old car radiator they used as a condenser. The other house cooked up a batch of tainted meth in a mobile home. But it’ll all be good once they mix the two.

It also cannot add to red ink beyond the first 10 years without facing the same fate.

If the mythical liberal media was real, the tv coverage would be showing which cuts the bills make permanent and which cuts end at 10 years or are faded out over time (such by ending inflation adjustments of deductions, etc. Guess who loses their goodies and who doesn’t?

I’m also surprised not to hear more about the loss of personal exemptions and how that affects families with more than 2 children. At 3 children and up, the benefit of the doubled standard exemption is totally lost. I don’t watch TV, though, so my impression of what has been covered may be off.

But needs to do it across the board.

In past times this woulda been the first item on the agenda after an election leaving GOPs in control of the WH and Congress. Tax cuts/reform is the Holy Grail of the GOP. Since 2009 however the GOP loaded up the Obamacare Repeal basket and squandered the electoral momentum they had coming out of November 2016. They’re not gonna pass tax “reform” this year. Too many of 'em playing re-election defense now and seeing the struggle that’s coming.

Amazing all the bs he says…Donald that is…

Also, a great news story would be to visit all the factories and businesses that have been opened and pay middle class wages to their workers because of all these massive tax cuts. And then maybe another one on the homeless children who live on the streets of NYC because the estate tax took away all their inheritance. -liberal media my aunt fanny -

Had to delete far too many anti Obama ads from the selection at the bottom of this article. They kept popping up in a different area as I deleted them for being offensive and I had to repeat the process a number of times before they disappeared. The bots are becoming more insistent it seems but who the hell is creating and paying TPM to air these scummy ads? Can’t TPM find a more legitimate source of ad funding. Never was bothered by the process before because it took just a couple of seconds to get rid of but this morning was very obnoxious.

Yup, the GOPers are throwing fiscal conservatism to the winds in order to pass this giveaway to the largest campaign contributors but fully intend to rediscover their principled fiscal conservatism come budget time when each and every one makes a speech on the floor decrying the unsustainable federal deficit and the need to make cuts(SS, Medicaid, Medicare) so as to lower the deficit they just created. Exactly what Cheney/Bush did. Have seen it estimated that fully 40% of the current federal debt is a direct result of those un-needed tax cuts.

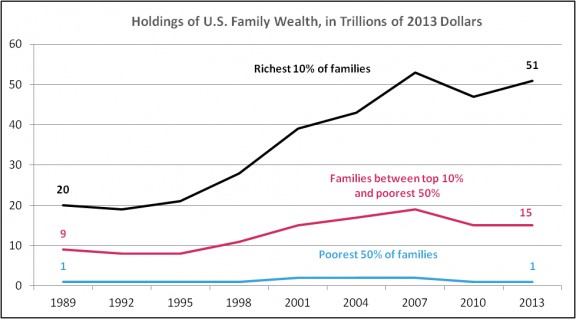

According to the GOP, the chart below should represent a country brimming with good jobs and good wages.

And it’s not like we’d end up with a repaired infrastructure, or educational improvements, clean water and air, or anything like that.

It’s just Republicans giving their billionaire donors $1.5 trillion.

The scam is they promise to give it back if we work hard enough for it.

Doesn’t make any economic sense.

GOPble, gobble…

“I remain concerned over how the current tax reform proposals will grow

the already staggering national debt by opting for short-term fixes

while ignoring long-term problems,” said Sen. Jeff Flake, R-Ala. “We

must achieve real tax reform crafted in a fiscally responsible manner.”

I see Sen. Flake has been demoted from Arizona to Alabama. That’ll learn him to retire!

Wouldn’t that $1.5 plus billion be better invested in infrastructure rather than squandered on multi-millionaires?

He got caught molesting an underage female.